Is Domestic Guarantee Distinct Credits Good to Pay-off Expenses?

HELOCs: Better than Bankruptcy proceeding to own Debt settlement?

Whether or not house guarantee lines of credit (HELOC) may seem like a fair provider, they are misleading. Bankruptcy proceeding can offer the perfect solution is than just household security lines off borrowing. Between writing on rates and enormous amounts of obligations, in fact repaying your balance may take a long time otherwise take a look quite difficult.

John Dunlap try a skilled attorneys that is trained in personal bankruptcy. Call now for a free 30 minute example to discuss why bankruptcy proceeding would be a better solution than just HELOC for the monetary situation.

What is a house equity credit line?

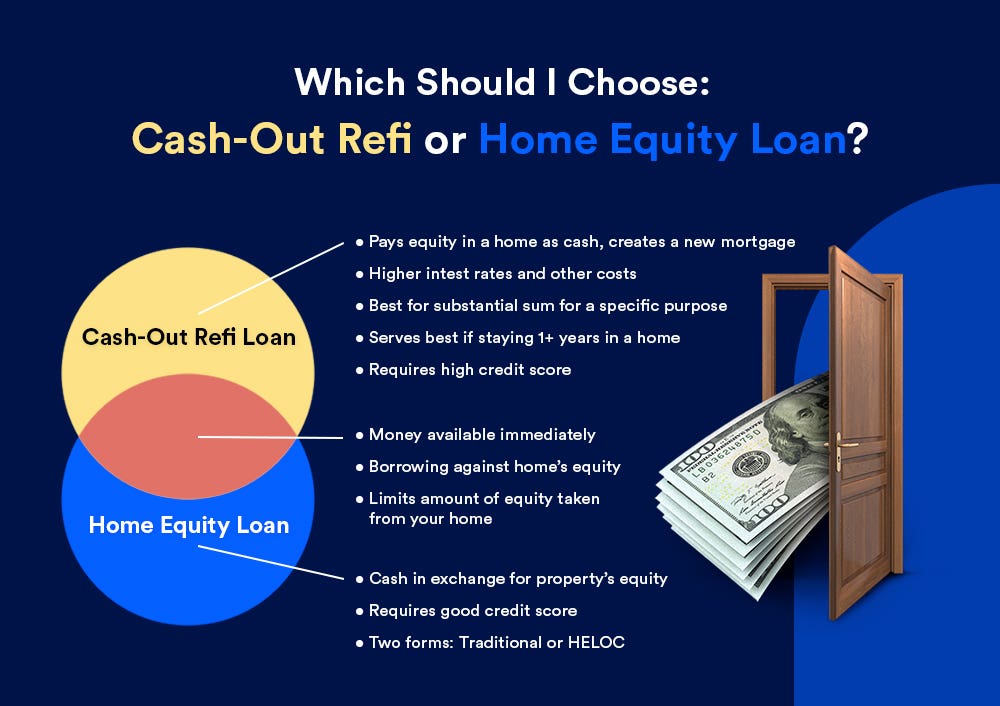

A beneficial HELOC is actually a great rotating credit line that can means ways a charge card really does. They uses brand new equity of your house due to the fact a lump sum payment and this can be borrowed, also known as a home security financing. You can borrow on brand new guarantee of your house and you may shell out it back into financial institutions.

Just like a credit line, you might obtain what you would like as long as it can not surpass the fresh arranged restrict credit line payday loans Saybrook Manor. For the majority home owners, a good HELOC lets these to acquire as often as required, which could seem guaranteeing. not, HELOC can lead to anyone paying additional money finally or losing their home in the process.

Family security credit can be used in combination with alerting, particularly if you happen to be using a good HELOC to pay off almost every other expense on account of financial strain. Studying the risks off a good HELOC is a vital action.

Ought i eradicate my family off an excellent HELOC?

There is certainly serious threats for many who default on your repayments just like the house equity personal lines of credit make use of domestic since security. Read More