Our very own economic requires and hopes and dreams will often outpace all of our current resources. Unsecured loan to own 50000 may be required to fund unanticipated costs, high-notice bills otherwise medical can cost you. Whenever like issues happen, examining the matter Just how much consumer loan do i need to log in to an effective ? fifty,000 paycheck is vital. In this web log, we’re going to discuss the circumstances away from eligibility, documents called for, interest levels and you will understanding to your loan amount based on income.

Lenders fool around with different ways to determine the loan amount to possess consumers. The latest multiplier means together with repaired responsibility so you can earnings ratio (FOIR) are two popular tips. Loan providers may use either of these two methods or each other to get a consumer loan to have good 50k salary.

Multiplier Method

The fresh multiplier system is also known as the amount of money numerous method. Its a common strategy used by lenders to evaluate financing eligibility considering one’s earnings. By this means, loan providers have fun with a fixed earnings multiplier between nine to thirty-six to have a-flat time period. The latest lenders’ algorithm to help you calculate the loan amount making use of the multiplier experience (Monthly paycheck x lay multiplier).

FOIR (Fixed Obligations so you can Earnings Proportion)

Repaired responsibility so you’re able to earnings proportion (FOIR) are a technique employed by loan providers in order to determine the borrowed funds qualifications of a borrower. It helps assess the borrowed funds EMI number a borrower can also be repay in a month. FOIR means the fresh new proportion out of a person’s fixed-income to possess inescapable expenses such as for instance lease otherwise present EMIs.

To decide your loan number, loan providers create earliest dictate your monthly repaired debt, instance EMIs, credit card payments or other economic responsibilities. The total amount will be split up by the monthly income so you can determine the new FOIR. The new FOIR percentage you to lenders favor is often forty% 50%. This means that your fixed debt will be if at all possible maybe not surpass more than just 40% 50% of your own monthly income.

Note- The actual number can differ from just one bank to another. Delight speak to your banker to track down a precise number.

Just how much Mortgage Do i need to get on 50000 Income when you look at the SBI

Inside County Financial from Asia, the loan number you can buy tend to differ based on products just like your loan’s purpose, credit rating, cost capacity or any other financial obligations.

Having an enthusiastic SBI unsecured loan getting good fifty,000 paycheck, maximum amount borrowed you have made will be ? 20 lakhs. SBI also offers home loans according to paycheck, in accordance with good fifty,000 salary, your house loan amount you can aquire could well be ?33,99,059. Please note the amount borrowed may vary according to abovementioned issues; see your banker to have a precise loan amount to your a great fifty,000 salary.

Personal loan Eligibility Getting 50000 Income

A consumer loan are a very important solution to economic stress. Although not, you need to obvious particular conditions to-be qualified to receive a loan. This type of qualifications standards are then followed making sure that the newest debtor can be afford payment and reduce the risk of standard. The private mortgage eligibility to possess 50,000 income is actually:

Files Needed for Reduced Paycheck Personal bank loan

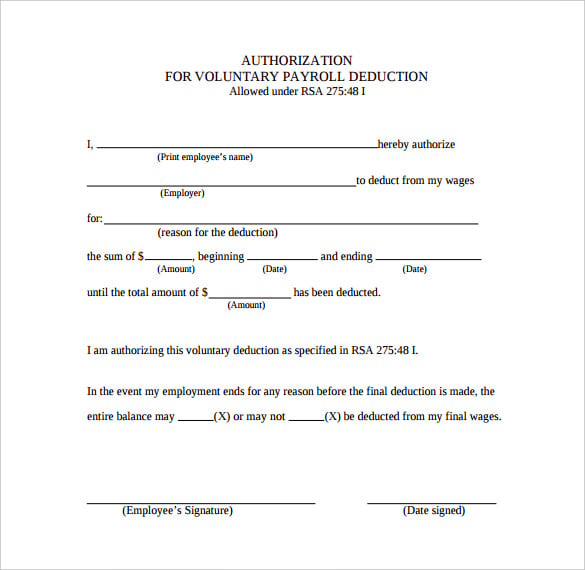

Protecting a personal loan which have an excellent ?fifty,000 salary requires the borrower to own called for records. Offering the correct files will guarantee loan approval. A number of the data files you’ll need for a low-income personal bank loan is:

Which are the Interest rate And other Costs?

To own an unsecured loan with the 50,000 income, the interest prices and you will fees was critical section you to definitely physically apply to the price of the loan. Understanding the real market pricing before applying for a financial loan assists people borrower to bundle the future finances. Additionally, researching new rates and fees of various loan providers will offer consumers even more understanding of delivering financing which have favorable words. Less than was a listing of loan providers in addition to their rates of interest and you may running fees:

Note: The newest pricing in the above list try at the mercy of transform on fund field and differ marginally with respect to the individual financial institutions.

How can i be eligible for a better Amount borrowed which have a paycheck regarding 50000?

Taking a better unsecured loan matter with a salary regarding ?50,000 is possible because of the knowing the situations loan providers consider within the review techniques. Implementing specific ways to showcase economic obligations usually rather help the likelihood of taking a better mortgage. Some actionable tips for you to follow is actually:

Manage an effective credit history: Good credit is important discover a better mortgage number. A credit rating is amongst the main determinants out of a good amount borrowed you to loan providers come across once you get a good financing. They reflects your creditworthiness and you will financial discipline. You need to take care of a strong credit rating to increase your loan matter eligibility. This can be done if you are online personal loans ND paying regarding credit cards and you can established debts timely. You can keep borrowing utilisation lowest and check to possess errors throughout the credit reports.

Decrease your debt-to-money proportion: Loan providers asses your debt-to-money ratio whenever deciding your loan number.A reduced DTI signifies that you have got throwaway income you can use to own loan fees. To minimize your DTI, you must repay expense and relieve so many expenses.

Boost a job stability: Lenders prefer borrowers with stable work and you may typical earnings. Working with a recently available workplace for a long period of energy demonstrates stability and you can grows your credibility while the a borrower. Prevent repeated occupations change, just like the lenders have a tendency to concern your loan repayment effectiveness.

Decide for an extended financing period: Having a paycheck from ?fifty,000, you can get a far greater loan should you choose a longer mortgage period. An extended financing period have a tendency to lower your monthly EMI so it’s a lot more in check for you to repay a bigger loan amount along with your paycheck. But not, an extended period will mean increased desire rates.

- Envision an excellent co-applicant otherwise guarantor: Is entitled to a better amount borrowed, you can attempt delivering an effective co-candidate otherwise guarantor with a high earnings otherwise credit score. It try to be a support for payment so you’re able to lenders, and so improving the probability of a far greater mortgage provide.

Achievement

When you find yourself wanting to know, How much personal loan can i log in to 50,000 income? The solution is dependant on a variety of items. The most loan amount is based on lenders’ computation tips for circumstances such as credit history, work balance, existing costs and you can Loan period. To boost your odds of getting favourable loan also offers, you could work at improving your qualification and repayment possibilities. Always keep economic health insurance and stability by exploring some other financing choice and you can teaching responsible borrowing.

In search of a quick mortgage? Buddy Mortgage makes it possible to rating a fast financing out of an option out of lender choices. Download brand new Pal Financing App about Play Shop otherwise Application Shop and implement for a loan today!