NEW How to do balance sheet reconciliation in 2025 definition & examples

We have included a free Excel template for running a manual system. As a small business, it’s crucial to maintain a fixed asset register. This register serves as a comprehensive record, detailing all the information about each asset your business owns. Not only does it help in tracking the value and condition of your assets over time, but it also plays a vital role in financial management, ensuring accurate depreciation calculations. how to make a balance sheet Fixed assets or long-term assets are things a business owns that it plans to use for a long period of time.

- As a small business, it’s crucial to maintain a fixed asset register.

- A smaller equity percentage might result in higher ROE through effective leverage, while a larger asset base can enhance ROA if managed efficiently.

- A lender will usually require a balance sheet of the company in order to secure a business plan.

- However, the company typically reinvests the money into the company.

Microsoft Word Business Startup Financial Statement Template

His expertise spans various industries, consistently providing accurate insights and recommendations to support informed decision-making. Rick simplifies complex financial concepts into actionable plans, fostering collaboration between finance and other departments. With a proven track record, Rick is a leading writer who brings clarity and directness to finance and accounting, helping businesses confidently achieve their goals.

- If you’re looking to see where your business stands, a balance sheet can help you do that.

- By organizing your data correctly, using formulas to simplify calculations, and leveraging AI tools like ChatGPT, you can streamline the process and ensure accuracy.

- Dividends paid to shareholders during the accounting period represent the portion of profits distributed to shareholders.

- Whether you’re creating dashboards, reports, or timelines, Bricks provides the tools you need to manage your data effectively and efficiently without needing to be a spreadsheet expert.

- It presents the company’s assets, liabilities, and shareholders’ equity.

- Assets are typically listed as individual line items and then as total assets in a balance sheet.

- Setting the right foundation from the start will make the process easier as you move forward.

How to Prepare a Balance Sheet: 5 Steps for Beginners

Do you want to Legal E-Billing learn more about what’s behind the numbers on financial statements? If you want to dive into creating a balance sheet, download our free financial statement templates to start practicing. The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line item by total assets and multiplying by 100. Current assets are assets that a company can easily convert into cash within a financial year.

How to Prepare a Balance Sheet

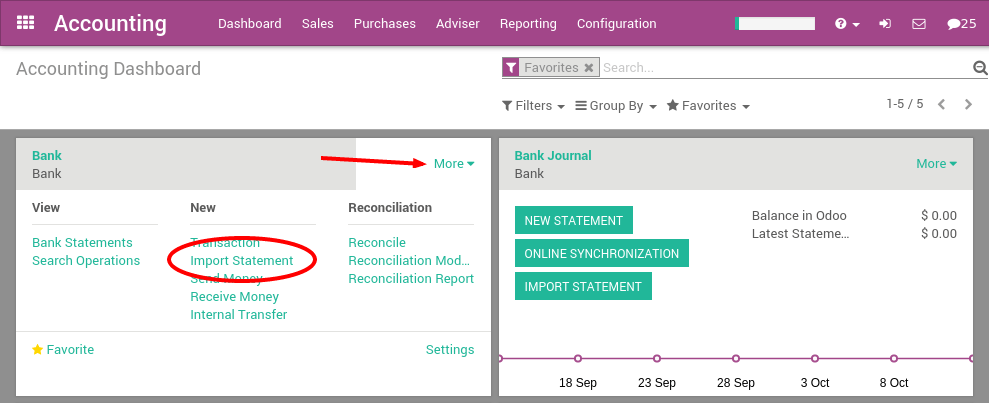

However, creating balance sheets on a quarterly or monthly basis can be a time-consuming process, even with accounting software or bookkeeping software. A balance sheet is one of the three common financial statements released by a business. They do this by subtracting all of a company’s liabilities and shareholder equity from its bookkeeping assets. Often, a reporting period is the same as a company’s accounting period. This time period is important to understand for your company when preparing a balance sheet. And other types of funding methods may also require seeing your financial position before approval.

Step 4: Calculate Shareholders’ Equity

Let’s start with the categories of assets that are easier to sell, called current assets. If not distributed as dividends, profit ends up in the equity shareholders’ accounts as retained earnings. A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment. A balance sheet covers a company’s assets as defined by its liabilities and shareholder equity. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.